CPF is an extensive social protection system in Singapore. It aims to supply working Singaporeans and Long lasting Citizens that has a safe retirement by lifelong cash flow, healthcare, and residential funding.

Key Parts from the CPF System

Common Account (OA):

Employed for housing, insurance coverage, investment decision, and education.

Distinctive Account (SA):

Principally for old age and expenditure in retirement-linked financial products and solutions.

Medisave Account (MA):

Specifically for medical expenses and accredited health-related insurance.

Retirement Account (RA):

Established once you convert 55 by combining discounts from your OA and SA.

What's the CPF Retirement Account?

When you access 55 yrs old, your OA and SA discounts are transferred into a recently developed RA. The goal of this account is to ensure that there is a constant stream of income for the duration of your retirement many years.

Essential Features:

Payout Eligibility: Regular monthly payouts normally commence at age 65.

Payout Techniques: You are able to choose between distinct payout schemes like CPF Lifestyle which gives lifelong regular monthly payouts.

Bare minimum Sum Necessity: There’s a minimal sum prerequisite that needs to be achieved right before any excessive funds may be withdrawn as lump sums or employed in any other case.

How does it Function?

Generation at Age 55:

Your RA is instantly designed utilizing savings from a OA and SA.

Building Your Retirement Price savings:

Further contributions is often made voluntarily to boost the amount in the click here RA.

Regular monthly Payouts:

At age 65 or later, you start getting monthly payouts based on the balance within your RA less than techniques like CPF Existence.

Functional Case in point:

Imagine you are turning 55 quickly:

You've got $a hundred,000 inside your OA and $50,000 with your SA.

Any time you transform fifty five, these amounts are going to be transferred into an RA totaling $one hundred fifty,000.

From age sixty five onwards, you are going to acquire month to month payouts meant to previous all over your lifetime if enrolled in CPF Lifetime.

Benefits of the CPF Retirement Account

Assures a secure source of revenue all through retirement.

Assists take care of longevity risk by giving lifelong payouts through schemes like CPF Lifetime.

Offers versatility with diverse payout solutions tailored to personal desires.

By understanding how Each and every part will work together within the broader context of Singapore's social safety framework, controlling just one's funds towards acquiring a snug retirement becomes much more intuitive and successful!

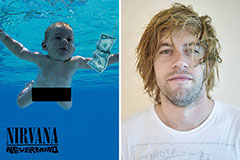

Spencer Elden Then & Now!

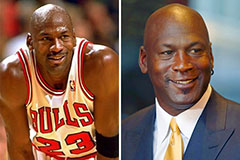

Spencer Elden Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!